Growing older frequently necessitates needing additional assistance beyond standard medical care. For instance, many seniors require long-term care, such as residing in a skilled nursing facility or hiring a home health assistant, because of illnesses, injuries, or other characteristics of ageing. In fact, according to the U.S. Department of Health & Human Services, there is a roughly 70% probability that an individual turning 65 today will require long-term care.

However, long-term care services may be quite costly. For example, Genworth estimates that the average monthly cost of in-home care, such as homemaker services or a home health aide, is around $6,000. It frequently pays to purchase long-term care insurance to assist lower what you could have to spend out of pocket because normal health insurance and Medicare do not cover the majority of long-term care costs and because you might not be able to or want to rely on family members to take care of you.

However, not all long-term care insurance plans are created equal. Their coverage, costs, eligibility, and other aspects of long-term care insurance might differ significantly. Therefore, experts consider the following when completing a long-term care insurance application.

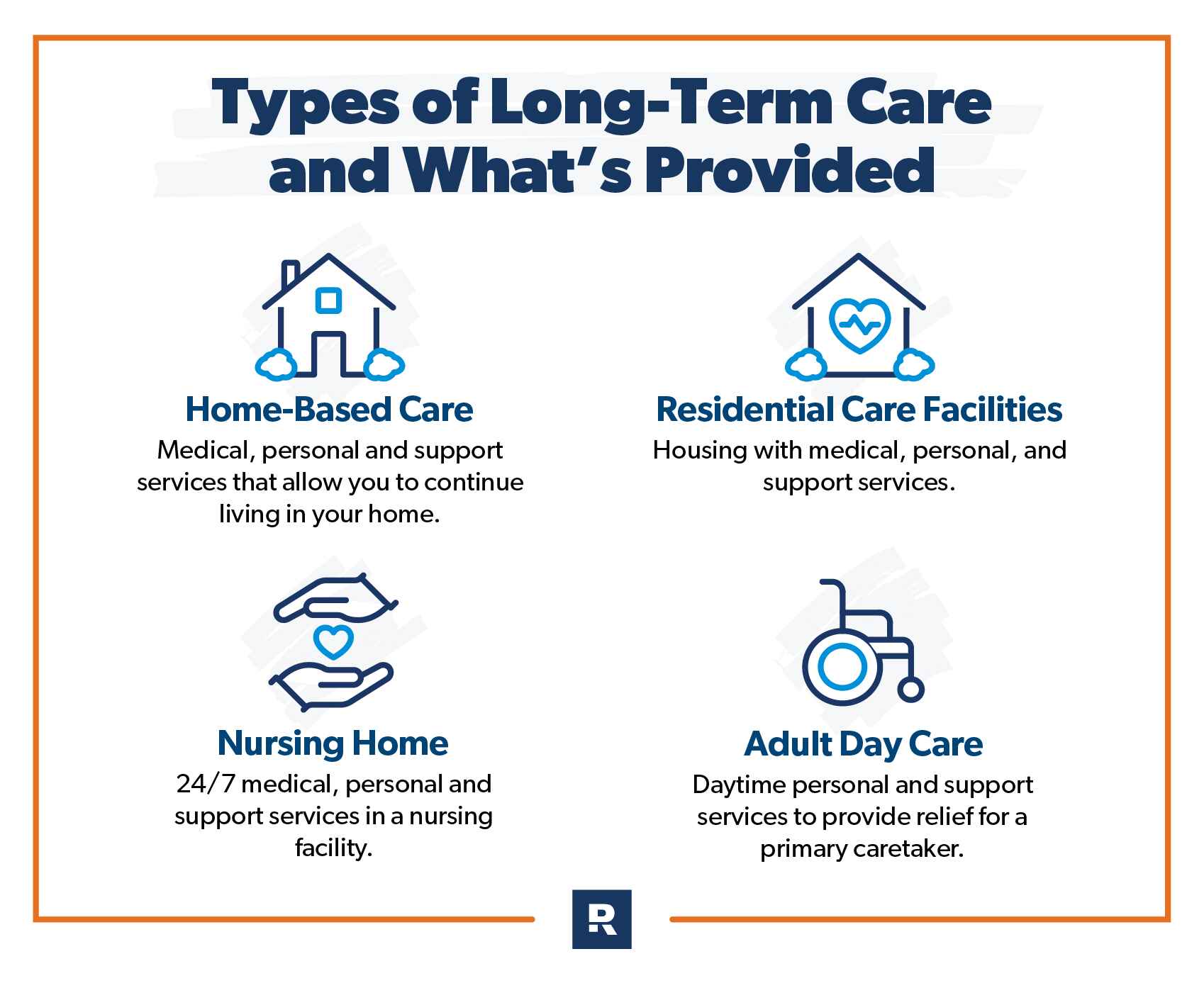

What Is Long-Term Care Insurance?

Image Source: Ramseysolutions

Long-term care (LTC) insurance covers personal or adult day care, home health care, and nursing facility care for those 65 years of age or older who require continuous supervision due to a chronic or incapacitating illness. When a person is unable to live freely, this coverage is intended to support them in doing so as securely and autonomously as feasible. This coverage may make extra money available to help cover the cost of extra support and services.

Duration of Benefits

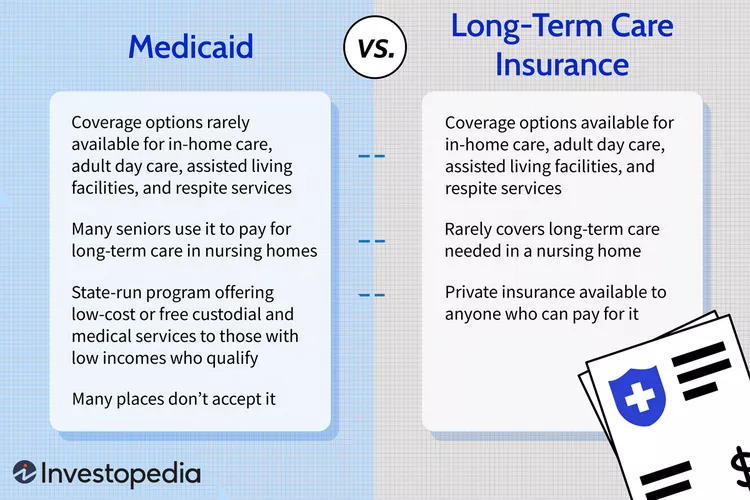

Image Source: Investopedia

Policies for long-term care (LTC) are often offered for care lasting 12 months or more. One-year policies, as well as those that payout for two, three, or five years, are available for purchase. Companies no longer offer perks that last for your entire life.

The benefit package for each year of long-term care insurance you purchase, together with other characteristics like your age and gender, will determine the premium you pay. Generally speaking, the coverage premium will cost more the longer the benefits last. Most individuals strike a compromise between the benefits they want to purchase and the premium amount they can pay.

Benefit Triggers

LTC insurance companies have requirements that must be fulfilled before they will pay benefits. Benefits begin to accrue when a person becomes unable to carry out a certain number of activities of daily living (ADL), such as eating, dressing, or taking a shower, or when they have cognitive impairment or dementia brought on by Alzheimer’s disease or other illnesses.

A person’s capacity to carry out ADLs and cognitive capacities are assessed to identify functional or cognitive deficiencies. Benefits may be granted if an individual with a cognitive impairment or dementia needs assistance or supervision or is unable to perform a certain number of ADLs.

When two of the ADLs specified in the policy cannot be performed by the policyholder or when they have a major cognitive impairment or dementia, such as Alzheimer’s, policies sold in California are required to provide eligible benefits for home care, assisted living, and nursing facility care. Benefit triggers on older plans could differ.

The seven ADLs listed above are also included in the definition of ambulating or walking, which is included in the policy information for non-tax qualified (NTQ) insurance.

A TQ policy is typically more stringent than an NTQ policy. When you are unable to complete two ADLs, that is when a TQ policy can start paying benefits. Walking is one of the seven ADLs listed under NTQ regulations, which may make it simpler to be eligible for payments.

Intervals of Waiting

For LTC insurance, a waiting period functions similarly to a deductible. It is sometimes referred to as the elimination or deductible period and represents the time frame within which an insurance policy will stop disbursing benefits to an eligible individual.

Some opt out of a waiting period, meaning that their plans begin to pay as soon as they meet the eligibility requirements. Some choose to cover just the first thirty, sixty, or ninety days of medical expenses; hence, their plans don’t start paying benefits until the waiting period has passed.

Some firms provide plans without a waiting period or with a fixed policy deductible. In this instance, payments start as soon as you pay for the appropriate quantity of treatment and meet the eligibility requirements for care.

Some firms simply count the days you get paid care (service day waiting period) against the waiting period. In contrast, other companies count daily beginning on the day you become eligible and begin receiving care (calendar day waiting period).

Some employers only need you to complete this waiting period once in your lifetime; others demand that you do it every time you become eligible for benefits and require long-term care help or within a certain window of time—say, a few days or months. Most firms typically do not include the treatment you receive from family members during waiting time.

Make sure you comprehend the provider’s method for determining the waiting time for the coverage you are interested in. If not, it might end up being quite costly in the long run.

Benefit Amount Per Day

The maximum amount that LTC plans will pay for each day of care is known as the daily benefit amount. Certain insurance covers this amount for care received in a nursing home, but only a portion of that amount is for care received in other settings.

For instance, if the maximum daily benefit amount for care in a nursing home is $100, then in California, plans issued after 1999 must provide a daily benefit equal to 70% of that amount, or $70, for assisted living. Benefits for in-home care must equal at least $50 but not less than 50% of the benefits offered by nursing homes.

In each location covered by the insurance, some firms will pay up to 100% of the daily benefit amount or the daily cost, whichever is lower. If the cost of a given day exceeds the daily benefit you purchased, the firm will often not cover the difference.

Some businesses provide home care benefits on a weekly or monthly basis in order to facilitate more efficient and economical scheduling, planning, and funding of care. It is vital to understand not only the entire amount covered by the insurance but also the process and distribution of a daily benefit.

Maximum Policy Benefits

The entire amount that an LTC policy will pay for your care once you start utilizing your benefits is equal to the maximum policy benefits. Companies in California are obligated to pay these benefits using the pool-of-money technique, which is sometimes referred to as a total dollar amount. This means that the maximum benefit that the policy will pay must be determined by a single dollar number that is paid for all covered benefits during the policy.

Conclusion

There are benefits to purchasing long-term care insurance before you turn sixty if you determine that this is the best method to plan for your care requirements in later life. In most situations, you will not only improve your chances of being authorized but also receive a reduced rate. Remember that pre-existing conditions can have an impact on both the cost of the insurance and your ability to obtain coverage.