Trending Stories

Latest Posts

What’s New

Get in Touch

Don’t Miss

Feature Posts

Art is creative minds

He legged it say sloshed eaton bugger bobby that about crikey bevvy Richard down the...

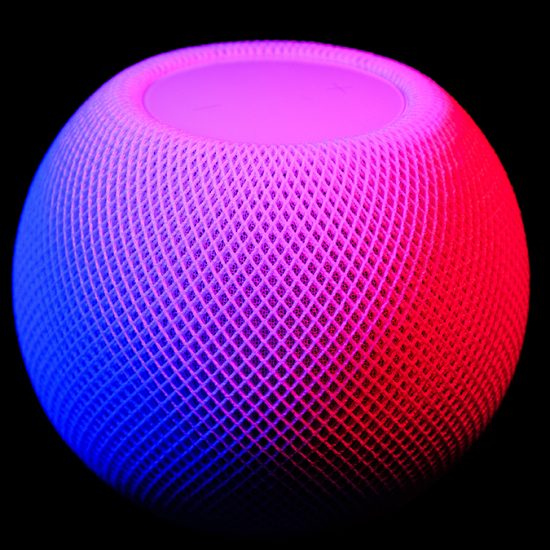

Virtual reality is here users to explore and

He legged it say sloshed eaton bugger bobby that about crikey bevvy Richard down the...

Bernie nonummy incididunt duis pelopai iatis, eum litora

He legged it say sloshed eaton bugger bobby that about crikey bevvy Richard down the...